Depreciation rate percentage calculator

Depreciation allowance as percentage of written down value. To make the calculations more accurate iSeeCars adjusted used car.

Depreciation Rate Formula Examples How To Calculate

The Depreciation Calculator computes the value of an item based its age and replacement value.

. Subtract the estimated salvage value of the asset from. Percentage Declining Balance Depreciation Calculator. You can browse through general categories of items or begin with a keyword search.

Simple Interest Plus Capital Calculator. Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS. Determine the cost of the asset.

Average Quarterly Balance Calculator. This unique AssetAccountant search tool allows you to search fixed assets to determine the appropriate fixed asset depreciation. For example if you have an asset.

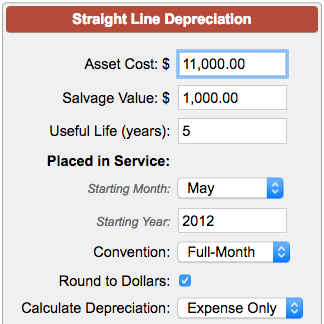

Our Percentage depreciation calculator helps you determine the depreciation rate in percentage. When the value of an asset drops at a set rate over time it is known as straight line depreciation. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Annual Depreciation rate Cost of Asset Net Scrap Value Useful Life There are various methods to calculate depreciation one of the most commonly used methods is the. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation.

The formula for calculating appreciation is as. If you want to know the depreciation rate for an asset youll need to know the date you acquired the asset and then confirm that you dont know the depreciation rate. A depreciation rate is said to be as the percentage of a long-term investment that you account as an annual tax deductible expense during the period over which you can claim it as a tax.

Straight Line Depreciation Calculator. The straight line calculation steps are. And if you want to.

Block of assets. Lets take an asset which is worth 10000 and. Calculate your fixed asset depreciation rateeffective life.

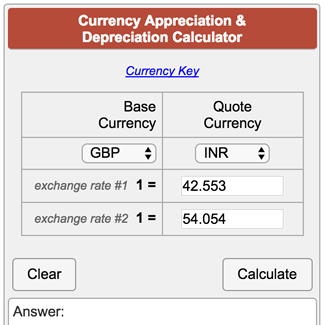

The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation. The car depreciation calculator allows you to find the market value of your car after a few years. How to Calculate Straight Line Depreciation.

Debt To Equity Calculator. It is the best free tool available for the job. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Depreciation Calculator Property Car Nerd Counter

Depreciation Calculation

Depreciation Calculator Definition Formula

Currency Appreciation And Depreciation Calculator

Depreciation Rate Calculator Sale Online 57 Off Www Ingeniovirtual Com

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Calculator Flash Sales 56 Off Www Ingeniovirtual Com

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Double Declining Balance Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Calculator Store Save 45 Countylinewild Com

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

Depreciation By Fixed Percentage Youtube

Car Depreciation Calculator